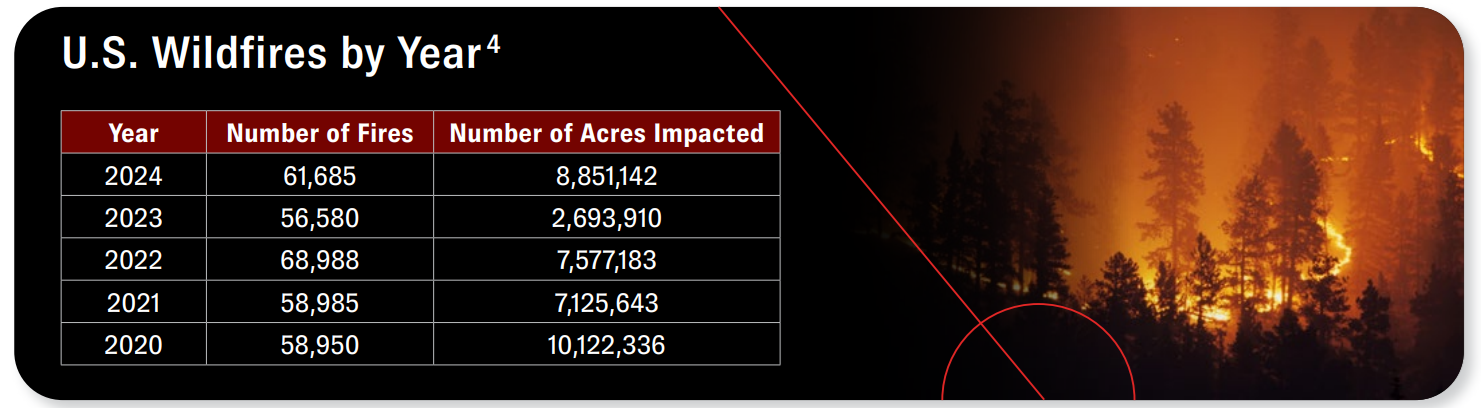

Wildfires are no longer rare events—they’re a recurring threat in many regions across the U.S., particularly in the West. In 2024, more than 2.6 million U.S. homes across 14 states were considered at moderate to very high risk of wildfire damage. Many will remember that in January 2025, wildfires fueled by Santa Ana winds devastated thousands of homes in Los Angeles. The total damage is still being calculated, but a preliminary estimate puts total economic losses north of $250 billion. Together, the Los Angeles fires are forecast to be one of US history’s most expensive natural disasters. These fires brought more scrutiny to wildfire exposure, spotlighting the danger to more populated areas.

As wildfire seasons grow longer and more destructive, insurers are tightening their underwriting requirements for homes in high-risk zones. In some cases, coverage is being restricted or denied altogether unless specific construction and mitigation standards are met.

The western United States typically experiences the most significant wildfire risk. The following states have the highest number of homes at moderate or greater risk of wildfire exposure:

- California: 1,258,748 homes at risk

- Colorado: 321,294 homes at risk

- Texas: 244,617 homes at risk

- Oregon: 129,567 homes at risk

- Arizona: 124,603 homes at risk2

These states face an elevated level of risk because of the high number of homes in less developed areas, or with more exposure to wildland-urban interface spaces, where homes are near wildlife such as trees, vegetation, and other flammable materials.2

Retail agents working with homeowners must be prepared to guide their clients through the changing landscape of wildfire-related risk. From vegetation management to building design, here’s what insurers require—and why.

DEFENSIBLE SPACE: THE FIRST LINE OF DEFENSE

Creating adequate defensible space is critical for insurability in wildfire-prone areas. Most carriers require at least 100 feet of clearance around a home to reduce the risk of advancing fires. This includes:

- Removing dead trees, dry grass, and dense underbrush

- Trimming tree branches within 10 feet of the home or chimney

- Clearing leaves and debris from gutters, decks, and the home’s foundation

- Eliminating highly flammable landscaping, such as Italian Cypress, which is now discouraged or outright prohibited by many carriers, especially in California

Some insurers may request photos or third-party inspection reports to confirm defensible space standards have been met.

CONSTRUCTION STANDARDS THAT MAKE A DIFFERENCE

How a home is built in wildfire zones can make or break its insurability. Increasingly, carriers are limiting coverage to homes that meet strict construction criteria, including:

- Class A fire-rated roofing (e.g., composition shingles, metal, or tile)

- Non-combustible siding such as stucco, fiber cement, or metal

- Double-paned or tempered windows to withstand radiant heat

- Ember-resistant vents to block ember intrusion

- Closed eaves (as opposed to open eaves or exposed rafter tails), which help prevent ember buildup

- No post-and-pier construction, which leaves a home’s underside more exposed to flames and embers Homes built or retrofitted with these features are more likely to qualify for standard market coverage.

Homes built or retrofitted with these features are more likely to qualify for standard market coverage.

ACCESS, RESPONSE TIME + RISK SCORING

Even if a home is fire-resistant, its location and access matter. Underwriters often evaluate:

- Distance to the nearest fire station or hydrant

- Road width and condition (to ensure fire truck accessibility)

- Community-level risk scores using tools that evaluate slope, fuel load, and historical fire activity

Homes in higher-risk zones may face higher premiums, stricter requirements, or coverage through the excess & surplus (E&S) market instead of admitted carriers.

MITIGATION REPORTS + DOCUMENTATION

Some carriers now require wildfire inspection reports before writing a policy. These reports assess property conditions and verify whether mitigation steps, such as brush clearance and vent upgrades, have been completed. Policyholders may need to provide:

- Before-and-after photos

- Proof of mitigation (e.g., contractor receipts or inspection certificates)

- Participation in local programs or community wildfire protection plans

Failing to document mitigation work can result in coverage being denied or limited.

DEDUCTIBLES, RESTRICTIONS + MARKET SHIFTS

If a policy is offered, homeowners should expect higher wildfire-specific deductibles, often calculated as a percentage of the dwelling limit (e.g., 5%). Additionally, many policies in wildfire areas now:

- Cap total coverage limits

- Exclude wildfire damage altogether

- Push coverage into non-admitted markets, where rates may be higher and consumer protections are limited

In short, the harder it is to protect the home, the harder it is to insure it.

HOW AGENTS CAN HELP

Retail agents play a critical role in helping clients navigate wildfire-related insurance challenges. That starts with understanding evolving underwriting standards and assisting clients to prepare proactively. Encourage builders and homeowners to:

- Choose fire-resistant materials from the start

- Maintain defensible space year-round

- Complete and document mitigation work

- Understand how location and construction impact coverage options

BOTTOM LINE

Wildfire risk isn’t going away—but with the proper construction and mitigation strategies, homes in high-risk areas can still be insurable. As carriers refine their requirements, agents must help clients plan, build, and maintain properties with wildfire exposure in mind.

CRC brokers can help retail agents evaluate evolving wildfire guidelines, access surplus market options, and craft tailored insurance solutions for even the most challenging locations. Reach out to your CRC Specialty producer today to learn more.

CONTRIBUTORS

- Brittany Martin has over 20 years of experience in the insurance industry and is a Personal Lines Team Leader for the Western Region.

END NOTES

- 2024 North American Wildfires, Center for Disaster Philanthropy, December 17, 2024. https://disasterphilanthropy.org/disasters/2024-north-american-wildfires/

- CoreLogic 2024 Wildfire Risk Report Finds More Than 2.6 Million Homes at Moderate to High-Risk of Wildfire Damage, Cotality, August 13, 2024. https://www.cotality.com/press-releases/corelogic-2024-wildfire-risk-report-finds-more-than-2-6-million-homes-at-moderate-to-high-risk-of-wildfire-damage

- Wildfire Risk to Homes, Roads, and Power Lines, Climate Central, September 4, 2024. https://www.climatecentral.org/climate-matters/wildfire-risk-to-homes

- 2025 U.S. wildfire statistics, Bankrate, January 24, 2025. https://www.bankrate.com/insurance/homeowners-insurance/wildfire-statistics/