What happens when a landmark real estate lawsuit triggers a wave of copycat litigation? The NAR antitrust case has upended how real estate professionals operate — and how they insure their businesses. Are your insureds ready for what’s next? Learn how the changing legal landscape is driving insurance challenges.

A 2023 lawsuit against the National Association of Realtors (NAR) changed how real estate agents are paid and dramatically disrupted the insurance market for real estate brokerages, agencies, and property managers. Since the NAR lawsuit, similar “copycat” lawsuits have popped up against local Multiple Listing Services (MLS) and real estate agencies. These legal challenges have triggered a domino effect, influencing brokerage practices and insurance coverage within the real estate industry.

In the lawsuit against NAR and several prominent real estate brokerages, plaintiffs alleged that the defendants violated antitrust law by forcing home sellers to pay inflated commissions. At the crux of the lawsuit was the NAR’s rule requiring blanket compensation offers as a percentage of the home sale price to be paid by the seller to the buyer’s agent. This compensation structure was needed to list a home via an MLS. Since MLS platforms are at the heart of the real estate industry, plaintiffs charged that the compensation requirement limited competition and violated antitrust laws.1

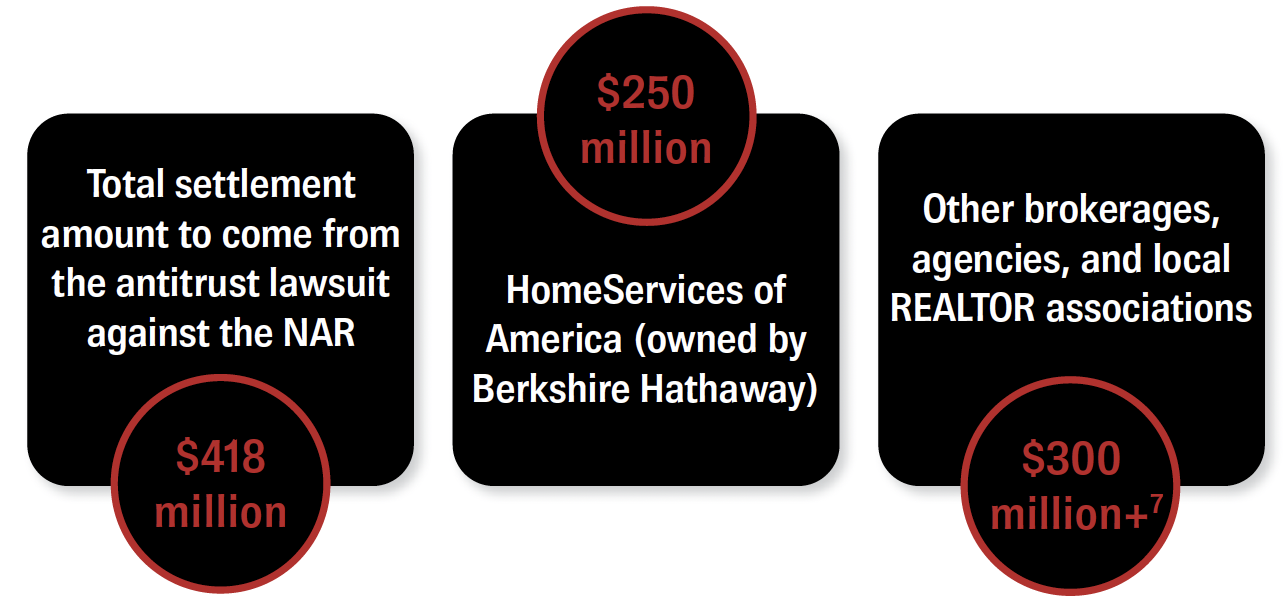

In October 2023, a federal jury ruled against the NAR and its codefendants, awarding plaintiffs $1.8 billion in damages. To resolve these claims, NAR agreed in March 2024 to a settlement involving a $418 million payout and significant policy changes that eliminate mandatory commission structures, enhancing transparency and competition in the real estate industry.

NAR SETTLEMENT INSPIRES SIMILAR SUITS

The NAR lawsuit inspired numerous similar lawsuits against local multiple listing platforms. For example, in Utah, a classaction lawsuit was filed in February 2024 against the MLS for four counties.2 The real estate company agreed to a $250 million settlement to resolve a series of class-action lawsuits.3 The National Association of Realtors also faces a second antitrust lawsuit over its requirement for members to join the organization at the national, state, and local levels.4

It’s not just real estate brokerages facing legal repercussions. Property management companies have also attracted regulatory scrutiny and litigation. The U.S. Justice Department sued six large landlords for allegedly colluding on rental prices. The companies reportedly used algorithms and direct communication to coordinate rental prices, thus eliminating the element of competition from local rental markets.5 It’s possible that rental management companies that use algorithms or “pricing surveys” to set rent amounts could face similar litigation.

INSURANCE INDUSTRY CHALLENGES AND TIPS

The ongoing legal challenges facing NAR, local MLS platforms, and real estate agencies and property managers have significantly impacted the insurance market for real estate professionals. In February 2024, NAR announced that its Errors & Omissions (E&O) policy had hit its limit due to ongoing legal issues. NAR used this coverage to provide legal defense protection to all local MLSs and REALTORS® associations. Local associations must independently fund a legal defense against antitrust lawsuits without this coverage.6

Unfortunately, agencies, brokerages, and local associations have few alternatives for E&O and Directors & Officers (D&O) coverage to protect against litigation. The pool of carriers has shrunk significantly as carriers have reduced coverage options. For those carriers still offering coverage, many have raised rates, reduced limits, and increased deductibles and other forms of coinsurance. Agencies and local associations facing renewal will likely see rate increases with fewer competitive alternatives.

While the insurance market has tightened, carriers still offer coverage to well-qualified applicants. Those looking for coverage should start the process six months before renewal. Agencies and associations should ensure their client handbooks, roadmaps, and guides have been updated to provide transparency about commissions, market data, and other competitive factors. They may also want to work with legal counsel to ensure their policies comply with antitrust laws. Those agencies and associations that have taken steps to increase transparency are more likely to find competitive coverage and renewal options.

BOTTOM LINE

The lawsuit against NAR and the subsequent settlement have rocked the real estate market. However, coverage options remain available for insureds who do their due diligence and update their policies and procedures, especially regarding commissions for buyers’ agents.

An experienced and knowledgeable wholesale insurance broker can help agents and clients find coverage that suits their needs and budget. Contact your CRC Specialty producer today to learn more about the changing coverage landscape for real estate organizations.

CONTRIBUTORS

- Mike Edmonds is an ExecPro Broker with CRC Seattle.

END NOTES

- Home buying costs could fall in big US real estate group settlement, Reuters, March 15, 2024. https://www.reuters.com/legal/big-us-real-estate-group-settles-litigation-over-inflated-commissions-2024-03-15/

- Commission lawsuits head to Utah, HousingWire, February 12, 2024. https://www.housingwire.com/articles/commission-lawsuits-head-to-utah/

- Berkshire Hathaway’s real estate firm to pay $250 million to settle real estate commission lawsuits, Associated Press, April 26, 2024. https://apnews.com/article/real-estate-commission-lawsuit-homeservices-warren-buffett-f933f5997d8e1e1d90549c00af84493e

- NAR faces another antitrust accusation over its three-way membership agreement, HousingWire, on November 13, 2024. https://www.housingwire.com/articles/nar-antitrust-lawsuit-three-way-membership-agreement/

- Justice Department Sues Six Large Landlords for Algorithmic Pricing Scheme that Harms Millions of American Renters, U.S. Department of Justice, January 7, 2025. https://www.justice.gov/archives/opa/pr/justice-department-sues-six-large-landlords-algorithmic-pricing-scheme-harms-millions

- NAR runs out of liability insurance coverage: Sources, HousingWire, February 16, 2024. https://www.housingwire.com/articles/nar-runs-out-of-liability-insurance-coverage-sources/

- Judge approves US realtor group’s $418 mln sales commission settlement, Reuters, November 26, 2024. https://www.reuters.com/legal/litigation/judge-approves-us-realtor-groups-418-mln-sales-commission-settlement-2024-11-26/#:~:text=The%20agreement%20came%20after%20a,worth%20more%20than%20%241%20billion.