Are your clients covered adequately for today’s domestic terrorism risks? With terrorism threats evolving and domestic events on the rise, is the current insurance safety net enough? Discover why TRIPRA may no longer provide the protection your clients need — and how the private market offers stronger, more flexible alternatives.

When discussing hot-button issues in insurance, terrorism coverage often takes a back seat. Yet, given the rise of politically, socially, and ideologically motivated violence in the U.S., it’s time to revisit how we manage this risk — and ask whether the the Terrorism Risk Insurance Program Reauthorization Act (TRIPRA) is still the best solution.

Created in the wake of 9/11, the Terrorism Risk Insurance Program (TRIP) was designed to provide a federal backstop for catastrophic foreign terrorism losses at a time when the private market lacked capacity. The reauthorization of the Terrorism Risk Insurance Act (TRIA) under TRIPRA has served as vital financial protection ever since.

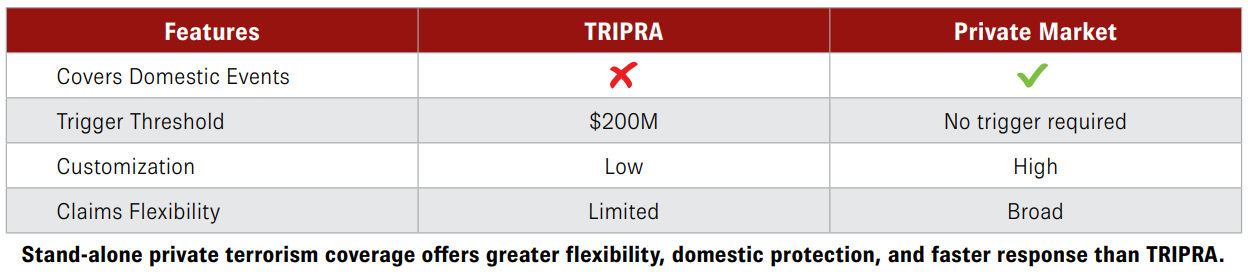

However, over two decades later, the landscape looks very different. The private market has matured significantly, offering greater variety and flexibility in stand-alone terrorism policies. Meanwhile, the domestic threat has grown more complex, decentralized, and before technologically enabled, pushing the boundaries of what TRIPRA can realistically address.

THE DOMESTIC REALITY

Social media and encrypted platforms have transformed recruitment and radicalization. In contrast to the face-to-face methods of the past, today’s extremists operate from a distance, cloaked in anonymity, spreading ideology and tactics at scale. Online training enables attackers to act alone with low-cost, low-tech weapons, but with devastating results, as was recently seen with the targeting of a fertility clinic in Palm Springs, California.

This shift has made attacks harder to predict and prevent and less likely to trigger TRIPRA’s protection. The federal backstop only applies to foreign-sponsored events meeting these three requirements:

- Certification of the Act of Terrorism: The event must be officially certified as an act of terrorism by the Secretary of Homeland Security and the Attorney General. This certification is a prerequisite for any federal compensation under TRIA.

- Program Trigger Threshold: The aggregate insured losses from the certified act of terrorism must exceed $200 million. This threshold has been in place since 2020 and remains unchanged through the program’s current authorization period, which extends until December 31, 2027

- Insurer Deductible: Each participating insurer must meet its individual deductible before federal compensation is available. The deductible is 20% of the insurer’s direct earned premiums from the previous calendar year in TRIA-eligible lines of insurance.

To provide perspective, from 2001 to 2021, there were 546 domestic terrorism incidents in the U.S., compared to zero foreign�sponsored events post-9/11. Investigations into domestic terrorism have also surged 357% in the past decade, according to government reports.1

WHY IT MATTERS TO PROPERTY RISKS

Despite this clear trend, TRIPRA hasn’t evolved to meet the new threat. Property insurers — strained by natural catastrophes and wildfire losses — continue to shoulder these growing domestic terrorism exposures.

Retail agents must consider whether TRIPRA alone can protect clients, especially when the risk is unlikely to meet its strict triggers. To date, no terrorism loss has ever been certified under TRIA/TRIPRA, which means coverage and claims remain unproven. Fortunately, the private insurance market now offers robust, customizable terrorism coverage — including domestic threats — with specialized underwriting and broader definitions.

BENEFITS OF STANDALONE COVERAGE

With tailored underwriting, customizable limits, and faster response times, standalone policies can provide more practical and responsive protection for today’s threats. Key advantages of standalone coverage include:

- Defines terrorism broadly with no need for official certification.

- Covers acts driven by political, religious, or ideological motives.

- Covers qualifying losses above any deductible—no minimum threshold required.

- Premiums are based on individual risk factors like occupancy, location, insured value, and limits.

- Rates are separate from all-risk programs, so they’re unaffected by general property/casualty rate hikes.

- Protects the claims history of a property policy from a catastrophic loss caused by an act of terrorism.

- Offers flexibility—insure only selected assets, including international ones, and tailor limits and deductibles to fit the exposure.

- Uses specialized adjusters for timely, proven claims handling.

- Can include coverage even without direct damage, like Denial of Access, Threat, Contingent Business Interruption, or Loss of Attraction.

BOTTOM LINE

The nature of terrorism has changed, but TRIPRA hasn’t. Retail agents can better serve clients by turning to experienced wholesale partners. With access to leading terrorism markets, tailored coverage solutions, and deep expertise, CRC can help protect your clients against today’s most pressing threats.

CONTRIBUTORS

- Chris Kirby is President of Starwind Specialty’s Political Violence & Terrorism (PVT) Program.

ABOUT STARWIND PVT

With over 30 years of underwriting experience, Starwind PVT brings unmatched expertise and product innovation to a complex, evolving risk landscape requiring comprehensive, client-specific solutions. Learn more here.

END NOTES

- The Rising Threat of Domestic Terrorism in the U.S. and Federal Efforts to Combat It, U.S. GAO, March 2, 2023. https://www.gao.gov/blog/rising-threat-domestic-terrorism-u.s.-and-federal-efforts-combat-it