The excess casualty market is facing mounting pressure as nuclear verdicts and outsized auto losses continue to rise. Insurers are demanding higher attachment points and adding new exclusions, creating significant challenges for businesses seeking coverage. With rates climbing and capacity tightening, understanding market dynamics and exploring alternative structures is more important than ever.

HIGHER RATES + ATTACHMENT POINTS

The impact of the capacity crunch in recent years is still being felt, and the rising number and size of nuclear verdicts, those above $10M, have made carriers wary of participating in lower layers on excess programs as auto and product liability awards continue to soar. The trend toward ever-higher awards in liability litigation drives sharp rate hikes for lead umbrella coverage and the first $25M of complex casualty risks as insurers scale back appetites and limits. While there is more competition in excess of $25M, insurers are still looking to take smaller tranches of large insurance programs.

Several carriers continue to offer $15M in lead umbrella capacity for clients with smaller auto fleets — less than 50 trucks with no extra heavy units. Those with larger fleets can typically expect a maximum $10M lead umbrella and possibly only $5 Million. Those carriers willing to put up a lead $10M may, in turn, require a higher attachment on the auto liability. This requires an auto buffer to get the auto liability attachment point to $3M, $5M, or even $10M, depending on auto fleet size and makeup. More competition exists on the higher, less loss-impacted excess layers. However, even with higher excess attachments, carriers limit their capacity to $10M or $15M. Those willing to provide a whole block of $25M are rare.

While cutting back capacity even at higher attachment points, carriers are also pushing to add their own exclusions related to PFAS, climate change, and addictive software/social media. In addition to the continued push on auto rates, real estate and hospitality risks are seeing greater rate pressure. While it is challenging, knowledgeable wholesale specialty brokers can leverage creative and alternative approaches to achieve the optimum insurance program.

NUCLEAR VERDICTS: A ROUGH RIDE FOR AUTO

Insurers have had a long, rough ride on commercial auto as social inflation continues to push third-party liability awards higher. The U.S. commercial auto insurance sector has been the weakest property and casualty line for over a decade, showing a net loss of $5B in 2023, followed by continued deterioration in the first half of 2024, as reported by AM Best.1

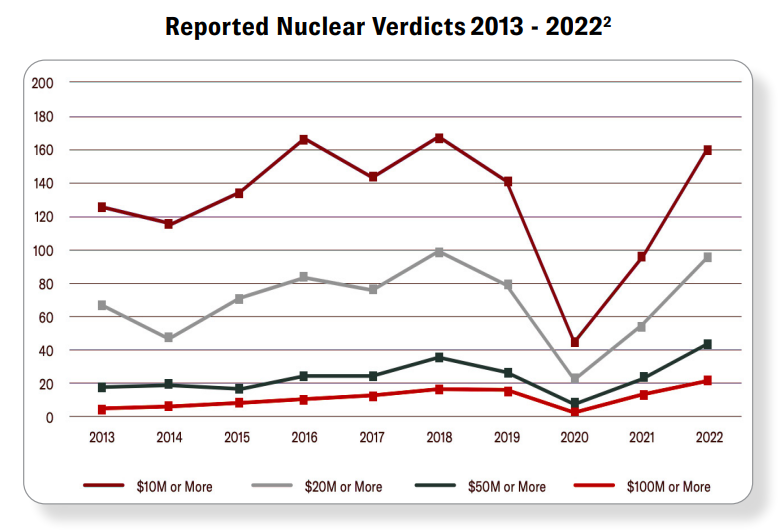

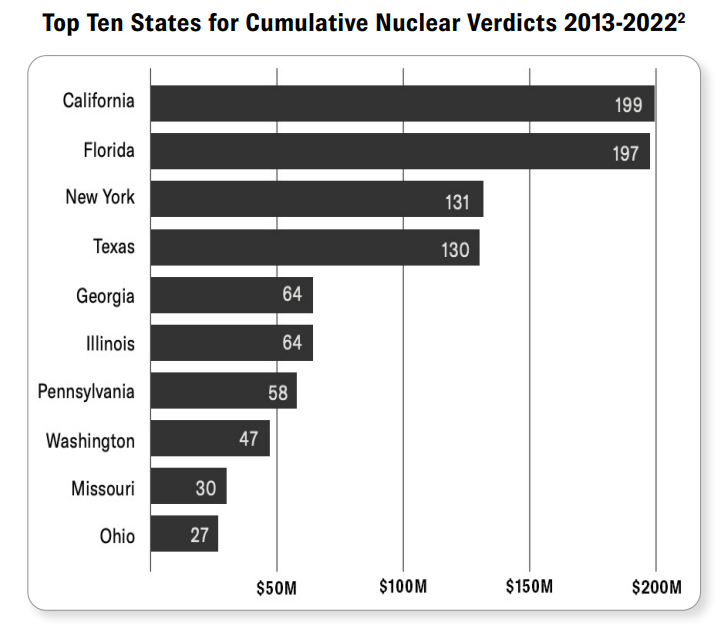

According to the Institute for Legal Reform, the average nuclear verdict for 2013-2022 rose to $89 Million for all claims. Although the trend toward higher nuclear verdicts paused during the COVID pandemic, verdicts rebounded to earlier levels by the end of 2021. A few problematic legal climates also play a significant role. Geographically, four states account for about half of all nuclear verdicts: California, Florida, New York, and Texas.2

RISING RATES ACROSS THE BOARD

The impact of adverse awards can also be seen in rate increases. While the average increases were in the mid-teens in 2024, complex and challenging accounts saw increases well above 20%, particularly where lead market capacity was limited, fleets were underpriced in prior years, and/ or adverse claims development coupled with exposure and inflation growth put pressure on actuarial models. The rising rates also reflect insurers’ reticence to participate in the first $25M, a limit that an average nuclear auto verdict would easily exceed.

Other areas seeing increased rate pressure include real estate and hospitality risks, where carriers have reduced or withdrawn capacity due to poor loss trends that have made these sectors unprofitable for many. Energy and natural resources accounts, including exploration and production, have seen rising prices and tightening capacity, stemming from concerns about action-over claims and contractual liability. Accidents can be dramatic and deadly in an industry involving explosive and flammable resources. Dual indemnification contract provisions, or knock-for-knock clauses, under which everyone involved shares the liability regardless of fault, often do not hold up in claims scenarios, resulting in multiple claims involving multiple insurance policies and greater costs for insurers.

AN EXPANDING LIST OF EXCLUSIONS

Huge product liability claims have also led insurers to add exclusionary language, including the so-called forever chemicals PFAS (per- and poly-fluoroalkyl substances). These have resulted in numerous lawsuits and settlements ranging into the hundreds of millions and even billions of dollars.3

Industry-specific exclusions include addictive software, like gaming or dating platforms. Video game developers and publishers have been the target of lawsuits in federal courts in several states.4 Ethylene oxide, which is used for sterilization by hospitals and other uses, is also targeted for exclusions. In addition, exclusions remain common for sexual abuse and molestation as well as assault and battery, particularly for habitational and real estate accounts, including assisted living facilities, student housing, or subsidized housing for the elderly. Habitational accounts are increasingly facing firearm and ammunition exclusions, while weapon and ammunition manufacturers are being targeted by lawsuits related to mass shootings. Crime scores can also play a major role in these segments. Newer exclusions include climate change, human trafficking, biometrics, and PFAS as previously noted. Wildfire, cyber liability, and sexual abuse and molestation continue to be sticking points, depending on class.

ALTERNATIVE STRUCTURES CAN HELP

The challenging market is leading insurers and brokers to assemble alternative structures, which may involve captive programs and matching or corridor deductibles. Increasing the auto attachment level for the lead umbrella coverage may also help soften the rate push. Historically, the auto attachment for the lead umbrella has been $1M CSL (combined single-limit), but carriers are pushing to raise attachments to $5M and, in some instances, $10M. Besides auto, the general liability market is encountering similar difficulties. With the lead umbrella markets seeking higher attachments for general liability and auto, demand for buffer layers to cover the gaps has grown.

Underwriters routinely report a high submission volume, so complete and thorough submissions are required to ensure priority review. Insurers need more detailed information on loss histories, safety, and risk mitigation programs. For any excess liability submission, whether auto or general liability, underwriters want loss summaries to develop estimates of future losses for the policy period. In addition to loss summaries for each line of business, going back a minimum of 5 years, carriers have also continued to request extensive loss summaries. Providing a complete loss picture, including the large loss summary, continues to be crucial to ensure a quick response and priority review from underwriters who are inundated with submissions as more business flows into the E&S marketplace.

Comparing how varying attachment levels may affect loss expectations can help obtain coverage. For instance, comparing the traditional $1M attachment point for auto liability with a $2M attachment could help. Those comparisons could be made at $5M and $10M for more extensive auto or general liability programs.

Risk management is a key consideration for insurers, so submissions should highlight how safety and risk mitigation programs have successfully controlled losses. Provided data may include telematics for auto, contractual reviews, loss mitigation activities, and responses to any adverse loss. Safety parameters and stories can also make a significant impact by illustrating how the safety plan is implemented.

BOTTOM LINE

Soaring court judgments and years of losses are taking a toll on the excess casualty market in an environment of growing social inflation where record verdicts engender even larger ones, particularly in auto and product liability. Insurers are reluctant to participate at lower levels in casualty programs and are generally more cautious, as an average verdict may climb higher than ever in an excess tower. In addition, insureds continue to face several new exclusions that make obtaining the appropriate coverage more challenging. In a complicated market, knowledgeable brokers can provide guidance on the best approach and develop alternative and creative programs to help your clients obtain the most appropriate insurance programs. Reach out to your CRC Specialty producer today.

CONTRIBUTORS

- Philip Jones is an Executive Vice President and Broker with CRC Atlanta.

- Nathan O’Tool is a Vice President and Broker with CRC Atlanta.

END NOTES

- Best’s Market Segment Report: U.S. commercial auto results in 2023 and first half of 2024 continue to deteriorate. AM Best, Nov. 13, 2024. https://news.ambest.com/newscontent.aspx?refnum=262099

- Nuclear Verdicts, An update on trends, causes and solutions, U.S. Chamber of Commerce Institute for Legal Reform, May 2024. https://instituteforlegalreform.com/wp-content/uploads/2024/05/ILR-May-2024-Nuclear-Verdicts-Study.pdf

- PFAS Lawsuit, ConsumerNotice.org. https://www.consumernotice.org/legal/pfas-lawsuit/

- Video game addiction lawsuits: Securing insurance proceeds for the next “worldwide epidemic,” Harvard Journal of Law & Technology, April 26. 2024. https://jolt.law.harvard.edu/digest/video-game-addiction-lawsuits-securing-insurance-proceeds-for-the-next-world-wide-epidemic

- Insurers are increasingly trying to push attachment points for excess layers up to $10mn, Insurance Insider US, January 29, 2025. https://www.slipcase.com/view/insider-us-in-full-cautious-optimism-double-digit-rate-growth-in-us-casualty-is-sustainable#:~:text=US%20excess%20casualty%20sources%20project,or%20less%20helping%20rate%20momentum