The senior living market is evolving under pressure from private equity, staffing shortages, inflation, and nuclear verdicts. As risks grow, retail agents face a maze of emerging exposures. Understanding these dynamics is critical to protecting clients and unlocking growth opportunities.

Senior living and long-term care (LTC) facilities play a vital role in supporting one of America’s fastest-growing demographics. The U.S. Census Bureau projects that by 2050, more than 82 million residents will be over 65, nearly double the figure in 2020.¹ This aging population ensures a steady demand for skilled nursing, assisted living, and memory care services. However, that demand comes with heightened scrutiny and increased risk, both operationally and financially.

The insurance marketplace surrounding these facilities has entered a new phase. Economic pressures, regulatory oversight, and an active wave of mergers and acquisitions are reshaping the sector. Private equity is deeply entrenched, buying up facilities and reorganizing operations, sometimes without the oversight necessary to ensure consistency of care. At the same time, litigation trends and rising costs erode liability limits faster than ever, creating a complex environment for underwriters and brokers.

For retail agents, the stakes are high. The marketplace remains full of opportunity, but helping clients secure sustainable coverage requires more than shopping for price. It requires a nuanced understanding of industry dynamics, evolving risks, and the strategic use of wholesale partnerships.

MACRO TRENDS IMPACTING THE MARKETPLACE

M&A. One of the defining features of today’s senior living market is the pace and scale of mergers and acquisitions. Private equity firms and real estate investment trusts (REITs) have poured into the assisted living sector, seeking to capitalize on demographic-driven growth. These buyers often acquire distressed facilities at steep discounts, rapidly consolidating them into larger portfolios. While these transactions may breathe financial life into struggling operators, they create insurance challenges. Ownership changes disrupt continuity, make it harder to secure loss data, and create uncertainty about operational standards. Underwriters, keenly aware of these inconsistencies, often respond with higher premiums and stricter terms, especially when new operators lack a track record.

Inflation. Economic pressures compound the issue. Inflation, elevated interest rates, and the rising cost of supplies and labor have all strained operating margins. Skilled nursing facilities, in particular, face steep staffing costs as they compete with hospitals and health systems that offer higher wages. Smaller operators without economies of scale are increasingly squeezed, with many seeking acquisition offers to remain viable.

Regulations. The regulatory environment further shapes the market. States like California and Florida are pushing for stricter nurse-to-patient ratios and higher staffing standards, which increase operational costs and liability exposures. Meanwhile, assisted living and memory care facilities face fewer regulatory hurdles, making them attractive targets for new development. Investors build high-end assisted living complexes in coastal or mountain communities to cater to affluent retirees, but these facilities are not immune to litigation or loss events.

INSURANCE MARKET CONDITIONS

Pricing in the senior living marketplace reflects this complex backdrop. On one hand, demographic-driven demand for services has helped stabilize rates, ensuring a steady flow of insureds seeking coverage. On the other hand, new entrants, particularly MGA-driven programs, are undercutting established carriers with lower pricing. However, it remains to be seen if these carriers have the claims handling infrastructure and experience required to respond adequately when large losses inevitably occur.

Capacity remains available but unpredictable. Most business is placed in the E&S market, where flexibility on terms allows for tailored solutions. Established carriers remain cautious, limiting the size of excess layers they are willing to offer. Meanwhile, new entrants have introduced more competition, but their long-term sustainability is uncertain. The result is a patchwork of pricing and capacity that varies widely by region, facility type, and operator history.

Although a handful of admitted carriers continue to write select business, especially for lower-risk facilities, the overwhelming majority of accounts are handled in the E&S market. This trend underscores the importance of brokers who can navigate E&S relationships and secure favorable terms while avoiding overly restrictive forms.

KEY RISK DRIVERS

Claims activity is one of the sector’s most pressing concerns. In particular, assisted living and memory care facilities are experiencing higher severity and frequency of claims, often driven by falls, elopements, medication errors, and allegations of neglect or insufficient supervision. These settings serve residents with increasingly complex medical and behavioral needs, which heightens the likelihood of adverse events and the associated liability exposure.

As claim frequency and severity rise, operators face escalating litigation costs, greater regulatory scrutiny, and upward pressure on insurance premiums. These trends can strain coverage relationships, reduce market capacity, and threaten long-term operational stability. Implementing proactive risk management strategies focused on early intervention, staff education, and consistent documentation is essential to curbing these trends and protecting both residents and providers.

Matching care needs. A major driver is the mismatch between resident acuity and facility staffing capabilities. In some cases, individuals with care needs beyond what the facility can provide are admitted, resulting in adverse events ranging from falls to aspiration incidents.

Litigation. Nuclear verdicts remain sporadic but dangerous. Recent multimillion-dollar verdicts in Kentucky and Tennessee demonstrate the risks. A Nashville jury awarded nearly $7 million in compensatory and punitive damages against an LTC facility and its parent companies after finding they failed to provide adequate nursing staff and that the Chief Nursing Officer did not meet the recognized standard of care. The plaintiff alleged falsified records, altered wound assessments, and misrepresented staff credentials.4 In Kentucky, a $12.9 million settlement was reached with a nursing home and a pharmacy following a resident’s death. The claim alleged negligence, which led to the resident’s death.5

Plaintiff attorneys are also increasingly sophisticated, using geo-targeted social media advertising to recruit plaintiffs and build cases against facilities. Combined with the rise of third-party litigation funding, this trend pressures carriers to settle rather than face the reputational and financial risks of a runaway jury award.

Staffing. Employee shortages remain a consistent driver of loss. Skilled nursing facilities struggle to compete with hospital wages, while assisted living facilities often rely on minimally trained, non-licensed staff. In some states, staff can begin providing care after as little as 40 hours of training. Turnover is high, particularly following acquisitions, further straining the quality of care and increasing exposure to claims.

Technology. Emerging exposures also warrant attention. Technology adoption offers promise. Wearables, fall detection systems, and radar-based monitoring can improve safety and attract families seeking reassurance. Yet technology also creates liability. Video footage of incidents can fuel litigation, and underwriters remain cautious about how these tools affect overall risk profiles.

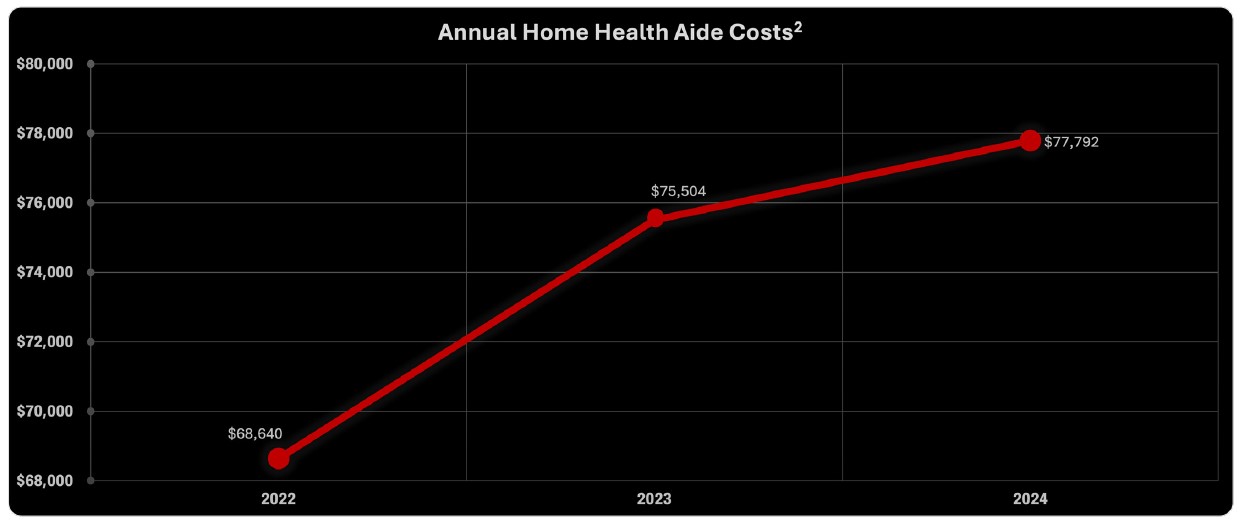

Meanwhile, home-based care and adult day programs are growing as alternatives. Medicare Advantage and some state programs are beginning to fund limited in-home services, while facilities are expanding into therapy and home health offerings. However, the cost of full-time in-home care remains prohibitive for most families, keeping facility-based care as the cornerstone of elder support.

COVERAGE CONSIDERATIONS FOR RETAIL AGENTS

The insurance marketplace for senior living is rife with potential pitfalls, especially for agents who focus solely on price. Many of the newer entrants use restrictive policy forms that introduce hidden exposures. Sublimits as low as $100,000 for abuse, elopement, or wrongful death are becoming more common. Triggers may shift from occurrence-based to written-demand, significantly narrowing coverage. Some forms even exclude critical exposures such as communicable disease or sexual abuse, forcing insureds to purchase costly supplemental policies.

Agents must also be proactive about leveraging risk management resources. Many carriers include site visits, mock surveys, and policy reviews as part of their offering. Encouraging insureds to take advantage of these services improves facility operations and strengthens the narrative presented to underwriters. Demonstrating robust fall mitigation plans, staff training programs, and quality improvement initiatives can make a meaningful difference in securing competitive terms.

Carrier loyalty is another factor that should not be overlooked. While switching carriers for a lower premium may seem attractive, long-term relationships often pay dividends when claims arise. Retailers should counsel clients on the benefits of consistency, particularly in a sector where underwriting confidence can be fragile.

GROWTH + OPPORTUNITY AREAS

Despite these challenges, the senior living sector remains rich with opportunity. The demand curve is undeniable: as the population ages, the need for facilities will only grow. Operators and insurers alike are exploring new models to meet this demand.

Active adult communities and wellness-driven facilities are expanding, catering to seniors who prioritize lifestyle and preventative care. These communities blend hospitality with healthcare, appealing to a generation of retirees who expect more than traditional nursing homes. Technology-driven care is another growth area, as facilities adopt proactive analytics and monitoring tools to improve safety and differentiate themselves in a competitive market.

For retail agents, the opportunity lies in positioning themselves as trusted advisors. Clients increasingly need guidance on what coverage to buy and how to interpret policy forms, navigate sublimits, and implement operational best practices that improve insurability. Agents who bring this expertise and partner with wholesale specialists to access the best options can build long-term relationships in a changing marketplace.

BOTTOM LINE

The senior living marketplace is both promising and perilous. Demographic demand guarantees growth, but private equity ownership, regulatory scrutiny, staffing shortages, and nuclear verdicts create volatility. Coverage remains available, but it’s key to navigate the market’s complexities with care.

Retail agents who take the time to understand evolving exposures, read policy language closely, and leverage wholesale expertise will stand out. Focusing on long-term stability rather than short-term price can help clients secure the protection they need while positioning themselves as indispensable advisors in an ever-changing marketplace.

Reach out to your CRC Specialty Producer for assistance in protecting your senior living clients today.

GUEST CONTRIBUTOR

Donna Hurley is the Director of Risk Management at Future Care RRG, Inc., where she and her team deliver proactive and creative solutions to reduce liability exposure and enhance operational performance across senior care communities in forty-eight states. With nearly two decades of experience and a deep understanding of the diverse long-term care industry, Donna brings a strong background in advocacy and a passion for advancing dementia care. She specializes in developing risk management programs that support quality outcomes, strengthen regulatory compliance, and promote resident safety. Donna and her team partner closely with direct care staff, administrators, and legal professionals to foster a culture of accountability, collaboration, and continuous improvement within the senior living and skilled nursing industry.

ABOUT FUTURE CARE RRG, INC

Future Care RRG, Inc. is a nationally recognized risk retention group serving senior care providers across forty-eight states. With decades of experience in the long-term care (LTC) sector, they deliver tailored insurance solutions, including professional liability, general liability, employee benefits liability, and supplemental coverages, built to meet the industry’s unique challenges and support the long-term success of their members. Learn more here.

CONTRIBUTORS

- Rusty Hughes is a Senior Broker & Healthcare Practice Group Leader with CRC Group’s Birmingham, AL office.

- Lee McClure is a Senior Healthcare Broker with CRC Group’s Birmingham, AL office.

- Truitt Taylor is a Senior Healthcare Broker with CRC Group’s Birmingham, AL office.

END NOTES

- An Aging Nation: Projected Number of Older Adults, 2020-2050, U.S. Census Bureau, February 2020. https://www.census.gov/library/publications/2014/demo/p25-1140.html#:~:text=This%20report%20examines%20how%20the,as%20Social%20Security%20and%20Medicare.

- Cost of Care Survey 2023, Care Scout. https://www.carescout.com/cost-of-care

- Senior-Living Industry Statistics, Senior Living, May 28, 2025. https://www.seniorliving.org/companies/statistics/

- Findings of Fraud Fuel $7 Million Verdict Against Long Term Care Provider, JD Supra, March 19, 2024. https://www.jdsupra.com/legalnews/findings-of-fraud-fuel-7-million-3528216/#:~:text=The%20jury%20further%20found%20that,plus%20$346%2C273.09%20in%20economic%20damages

- $12.9M Settlement For Nursing Home And Pharmacy Negligence Leading To Resident’s Death, Medical Malpractice Lawyers. https://medicalmalpracticelawyers.com/12-9m-settlement-for-nursing-home-and-pharmacy-negligence-leading-to-residents-death/