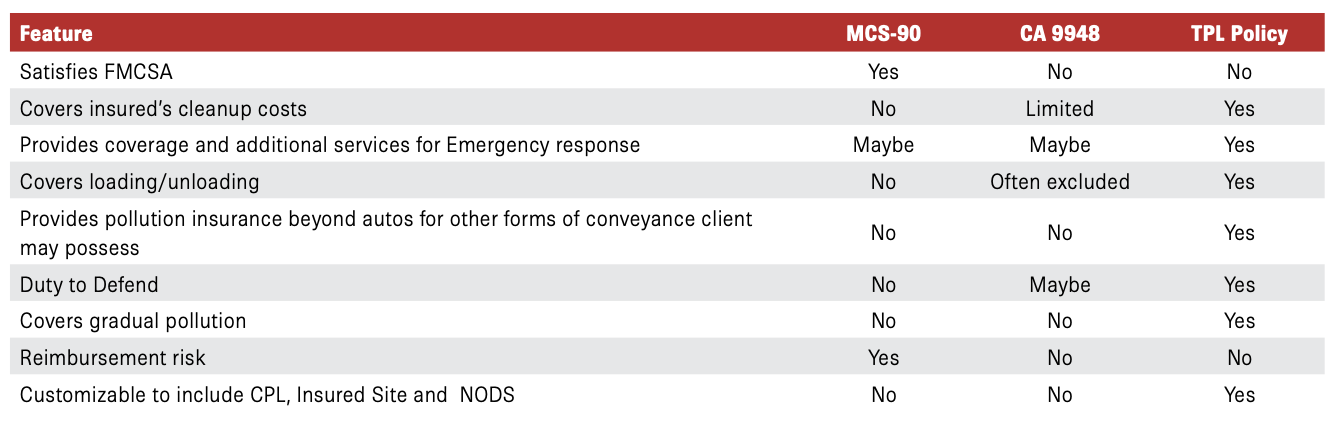

Are your transportation clients truly covered for pollution losses—or just compliant? Standard endorsements like CA 9948 and MCS-90 often fall short when it counts. Discover how a true Transportation Pollution Liability (TPL) policy fills critical coverage gaps and provides robust protection for today’s high-stakes environmental sector.

In the transportation and logistics sector, environmental liability is a growing concern. While many motor carriers assume their exposures are addressed through standard endorsements like CA 9948 or MCS-90, these forms offer limited, reactive, and sometimes inadequate protections. In contrast, a true Transportation Pollution Liability (TPL) policy provides comprehensive, proactive coverage designed for modern risk realities.

This article outlines the key differences between CA 9948, MCS-90, and a standalone TPL policy — and why insureds seeking robust environmental risk management must go beyond regulatory compliance endorsements.

THE BASICS OF COVERAGE: CA 9948 AND MCS-90

Up until recently, CA 9948 and MCS-90 have been instrumental tools in commercial auto insurance, particularly for motor carriers transporting hazardous materials. However, as risk managers, clients, regulators, and the general public increasingly prioritize environmental stewardship and protection, these tools may lack the necessary risk transfer capabilities to adequately protect businesses in the event of an environmental issue.

- MCS-90 Endorsement

The purpose of this endorsement is to establish federal financial responsibility for motor carriers transporting hazardous materials via interstate commerce. Its intent is to ensure that the public is compensated for environmental damage, even if the policy excludes the event. There are key limitations to this endorsement: the reimbursement clause allows the insurer to seek repayment from the insured; It only applies to public liability and not to the insured’s own cleanup costs or property; it is triggered only when the policy otherwise excludes coverage, meaning it is not a coverage grant; and it is not pollution insurance but rather a compliance tool.

In addition, the insurer is only obligated to pay any final judgment recovered against the insured. This effectively means the insurer has no duty to defend or obligation to cover defense costs. Only after a court judgment is the insurer obligated to take action. - CA 9948 Endorsement (Pollution Liability Broadened Coverage for Covered Autos – Business Auto)

The purpose of this endorsement is to add back some pollution coverage that is excluded under the ISO auto policy. However, there are key limitations: it only covers certain “accidental” pollution events directly from covered autos. There is no coverage for gradual pollution, loading/unloading incidents, non-owned autos or trailers, or cleanup of the insured’s own property. Additionally, the policy is often silent or coverage is denied on “materials being transported” if they are not listed pollutants.

THE COMPREHENSIVE ADVANTAGE: TRUE TRANSPORTATION POLLUTION LIABILITY

Unlike the endorsements mentioned above, a true TPL policy is a standalone form, designed from the ground up to provide broad and intentional coverage for pollution events resulting from a client’s transportation services. Key coverage features may include third-party cleanup costs, encompassing emergency response costs; third-party bodily injury and property damage; and defense and crisis management expenses. Additional differentiators making TPL insurance a critical risk transfer tool include:

- Coverage for loading and unloading

- Coverage resulting from pollution incidents while a vehicle is at rest

- Options to cover both owned and non-owned auto exposures

- Coverage for vehicles either on a scheduled or blanket basis

- Coverage provided for both gradual and sudden pollution events

Furthermore, the policy can be expanded to cover modes of transportation beyond autos, including railcars, boats, and other modes of transport that would not fall under the coverage provided by MCS-90 or CA 9948.

EXPANDED POLLUTION PROTECTION BEYOND THE ROAD

One of the most powerful differentiators of a TPL product is its ability to bundle broader environmental coverage beyond just auto-related exposures. Additional coverage parts can include:

- Contractors Pollution Liability (CPL): Protects clients that may perform other services at a third-party site that would fall outside the scope of “transportation services.” Many providers are now being required to show evidence of CPL insurance if they are entering a client’s site, regardless of whether they are providing any true “contracting services.”

- Insured Site Pollution Liability: Provides coverage for pollution at owned or leased facilities. It extends coverage to provide critical pollution liability if there is a pollution incident at an owned/operated site resulting from the use or operation of an auto, such as during loading or unloading, or a release from the client’s own auto while staged on site. It can also protect a client from pollution incidents for carriers with logistics, maintenance, and fueling operations conducted within their own facility.

- Non-Owned Disposal Site (NODS) Coverage: Covers liabilities arising from the insured’s generated waste disposal at third-party sites.

TPL VS. CA 9948 AND MCS-90: KEY TALKING POINTS

Claim Examples + How Each Mechanism May or May Not Respond

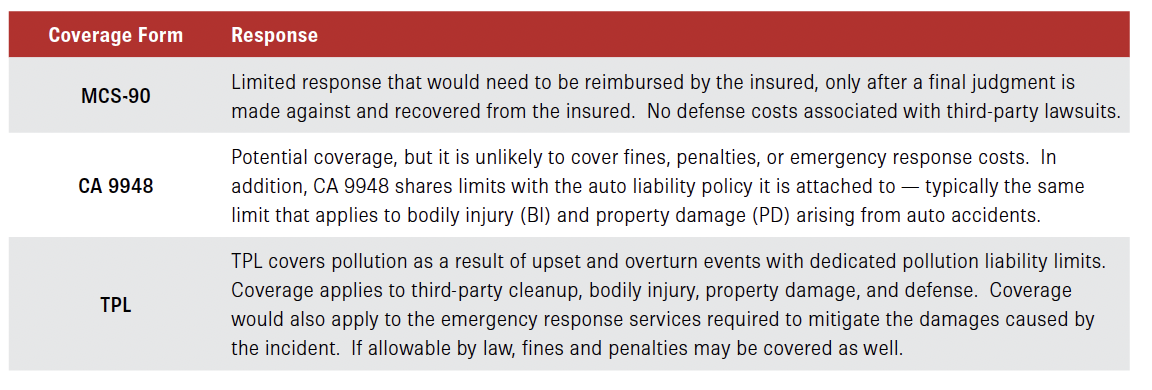

CLAIM EXAMPLE 1:

TRUCK OVERTURN DURING TRANSIT – RELEASE OF REGULATED MATERIALS AFTER COLLISION

While traveling on a major interstate, the insured’s tractor-trailer was involved in a multi-vehicle accident, causing it to overturn and spill cargo onto the highway and embankment. Punctured containers of paint and thinners released flammable liquids into a storm drain leading to protected wetlands. Breached adhesive drums reacted with rainwater, forming a hazardous sludge, while damaged lithium batteries began smoldering, prompting an emergency HAZMAT response and road closure.

- Damages:

- Emergency Response: $150,000 for HAZMAT, and containment.

- Environmental Cleanup: $275,000 for storm drain, soil remediation, and wetland mitigation.

- Third-Party Claims: $95,000 for business interruption from nearby facilities and a bodily injury claim from a responding officer who experienced chemical exposure symptoms.

- Fines + Penalties: $40,000 assessed by the state environmental protection agency.

POTENTIAL COVERAGE OUTCOMES:

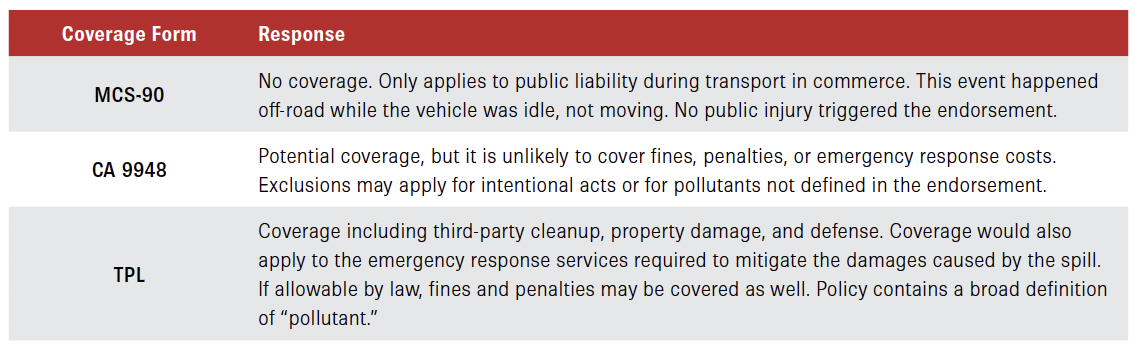

CLAIM EXAMPLE 2:

ARSON AT REST STOP TRIGGERS MAJOR ENVIRONMENTAL LOSS

While parked overnight at a rural rest stop, an insured trailer transporting cosmetics and household cleaning products—including aerosol deodorants, perfumes, disinfectants, and liquid cleaners—was intentionally set on fire by an unknown third party. The fire triggered explosions of pressurized containers, prompting a fire department response. Thousands of gallons of water used to suppress the blaze became contaminated with chemicals from the cargo. This runoff entered a storm drain and discharged into a nearby stream and wetland. Environmental authorities responded the next day following reports of fish kills and a visible chemical sheen in the waterway.

- Damages:

- Emergency Response: $110,000 for pollutant containment

- Hazardous Material Cleanup: $275,000 for removal and disposal of contaminated runoff

- Environmental Remediation: $400,000 for storm drain flushing, wetland restoration, and soil remediation

- Natural Resource Damages Claim: $150,000 for harm to aquatic life and ecosystem services

- Fines + Penalties: $35,000 issued by the state environmental agency for environmental violations

POTENTIAL COVERAGE OUTCOMES:

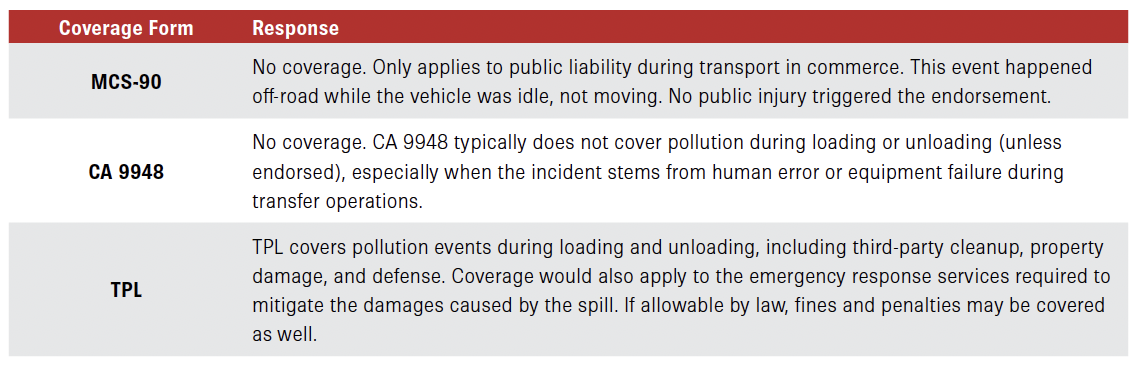

CLAIM EXAMPLE 3:

FUEL SPILL DURING LOADING — LOADING/UNLOADING + CPL EXPOSURE

A transportation company delivering diesel fuel to a commercial facility experienced a hose failure during loading due to improper coupling and lack of containment. Several hundred gallons of fuel spilled onto the property and entered the stormwater system, ultimately reaching a nearby creek and triggering a reportable environmental release.

Emergency responders were called to contain the spill and manage fire risk. The state environmental agency issued a stop-work order and required full remediation, including storm drain flushing, soil removal, and surface cleanup. The facility also filed third-party claims for damage to its paved surfaces and drainage infrastructure.

- Damages:

- Emergency Response + Remediation: $250,000 for containment, cleanup, and environmental mitigation

- Fines + Penalties: $50,000 in civil penalties and regulatory oversight fees

- Third-Party Property Damage: $40,000 for repairs to pavement and stormwater infrastructure

POTENTIAL COVERAGE OUTCOMES:

CLAIM EXAMPLE 4:

TANKER BREACH DURING STAGING — IDLE AUTO EXPOSURE

A trucking company is contracted to haul a load of liquid asphalt to a remote construction project. Upon arrival, the receiving site is not yet ready, so the tanker truck is directed to stage at a laydown yard adjacent to the project site for two days. During staging, a corroded valve fails overnight, and the load slowly leaks out onto unpaved ground, contaminating soil and migrating toward a nearby creek. A passerby reports the strong odor and sheen on the water.

- Damages:

- Emergency Response + Remediation: $400,000 for containment, soil removal, and creek protection measures

- Third-Party Property Damage: $60,000 for loss of adjacent farmland and destroyed crops

- Fines + Penalties: $50,000 assessed by the state environmental agency for failure to maintain equipment and prevent release

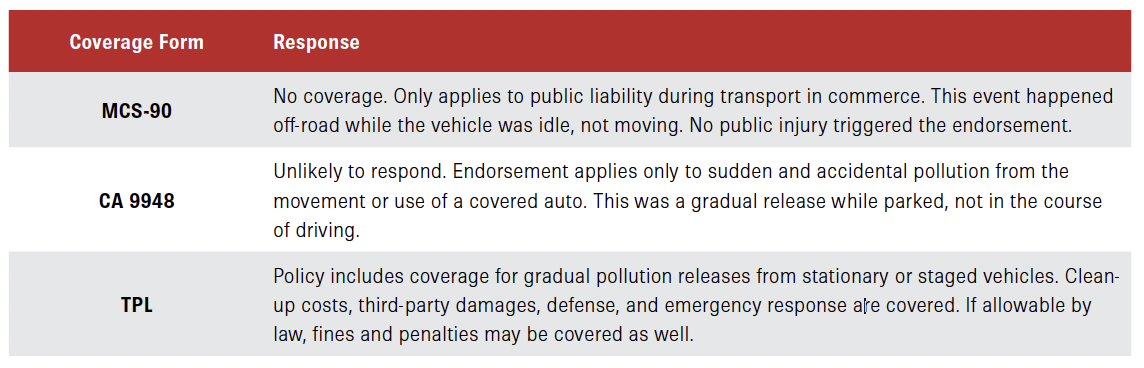

POTENTIAL COVERAGE OUTCOMES:

BOTTOM LINE

Endorsements like CA 9948 and MCS-90 may satisfy minimum compliance or regulatory requirements, but they are not pollution insurance. In a time of increasing environmental scrutiny, plaintiff-friendly verdicts, and contractor risk transfer requirements, companies need a more robust risk transfer mechanism. A comprehensive TPL policy offers true financial protection, broader risk transfer, and peace of mind for clients facing a more complex business environment.

Working with the right wholesale broker can ensure that your insureds have comprehensive coverage that meets their unique environmental exposure needs. Reach out to your CRC Group producer today.

CONTRIBUTORS

- Mike Padula is President of Starwind Environmental. As an industry veteran, Mike has more than 25 years of experience indiverse roles across environmental consulting, claims, and underwriting.

ABOUT STARWIND ENVIRONMENTAL

Starwind Environmental provides bespoke insurance solutions tailored to meet the distinct environmental risk transfer needs of your clients. Learn more here.

Disclaimer:

The claim examples are for illustrative purposes only and do not represent actual events. Coverage outcomes will vary based on the specific terms, conditions, and exclusions of the applicable policy and the facts of each claim. This content is not legal or claims advice. For details on coverage, consult your policy or a licensed insurance professional.